ohio sales tax exemption form reasons

Ohio sales tax exemption form reasons Monday June 6 2022 Edit. On the other hand contractors may purchase materials exempt from Ohio sales and use tax based upon an exempt real property.

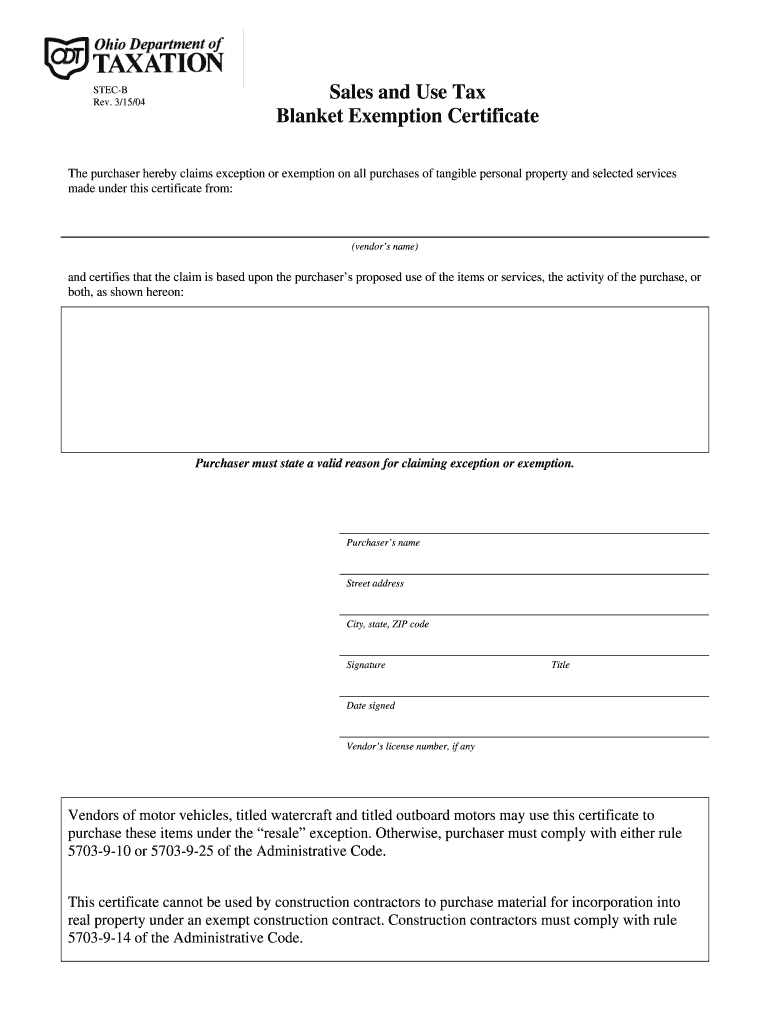

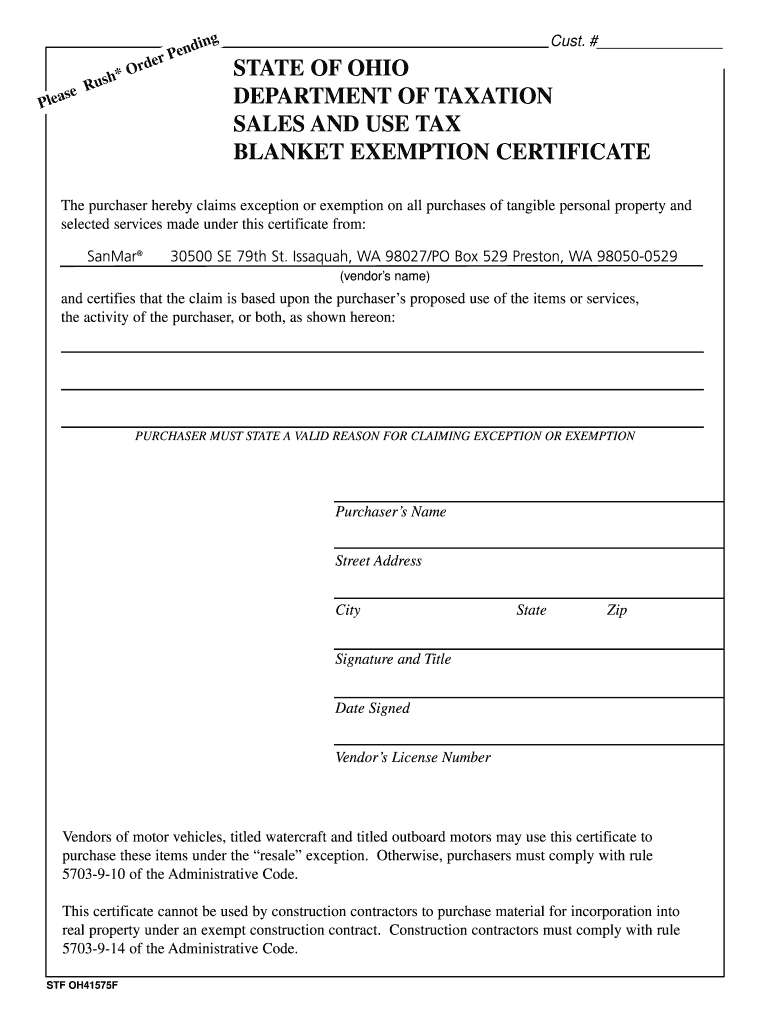

Tax Exempt Form Ohio Fill Online Printable Fillable Blank Pdffiller

The Ohio sales tax exemption for manufacturing is broad and encompasses a wide array of purchases used in the manufacturing process.

. Get Access to the Largest Online Library of Legal Forms for Any State. Exemption certificate forms A As used in this rule exception refers to sales for resale that are excluded from the definition of retail sale by division E of. The Clerk of Courts will record on the.

Counties and regional governments may also. OHIO UNIVERSITY PURCHASES ARE EXEMPT FROM SALES TAX BASED ON THE EXEMPTION FOUND IN SECTION 573902 81 OF THE OHIO REVISED CODE. Ad The Leading Online Publisher of Ohio-specific Legal Documents.

What is Ohio State tax exemption. If unsure on whether to claim sales tax exemption this article on Ohio sales tax exemption and reasons to apply is what you need. Sales and use tax.

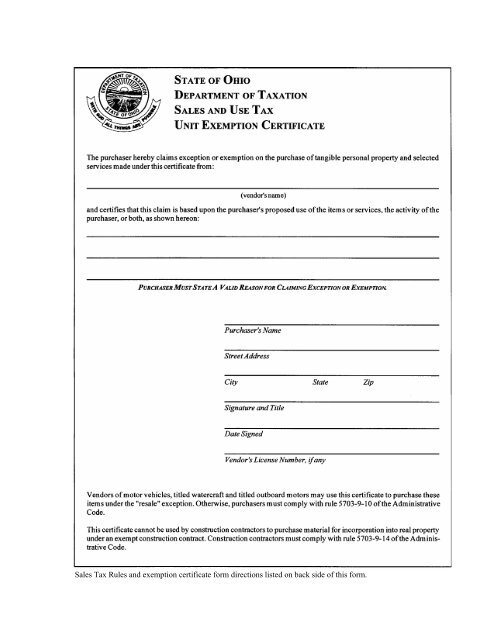

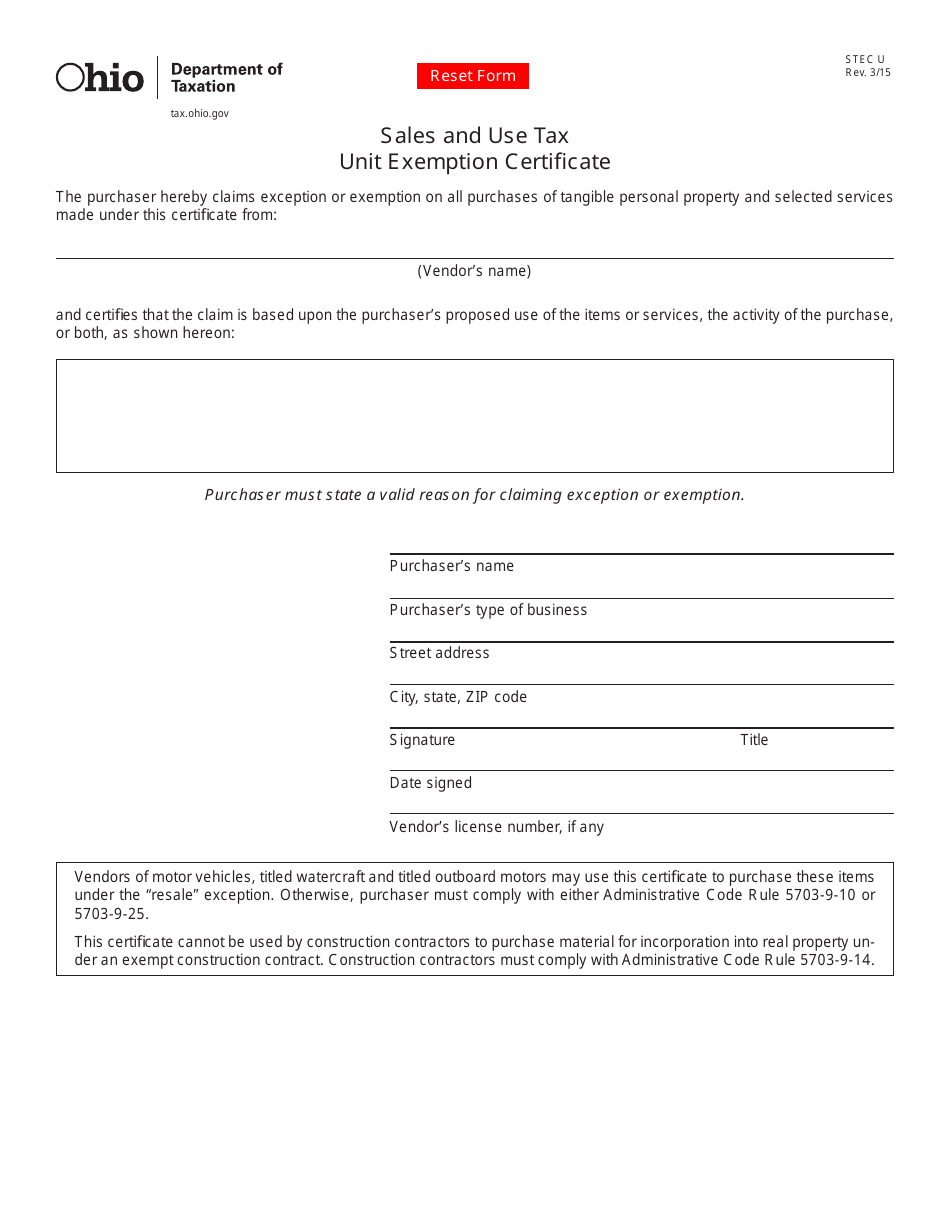

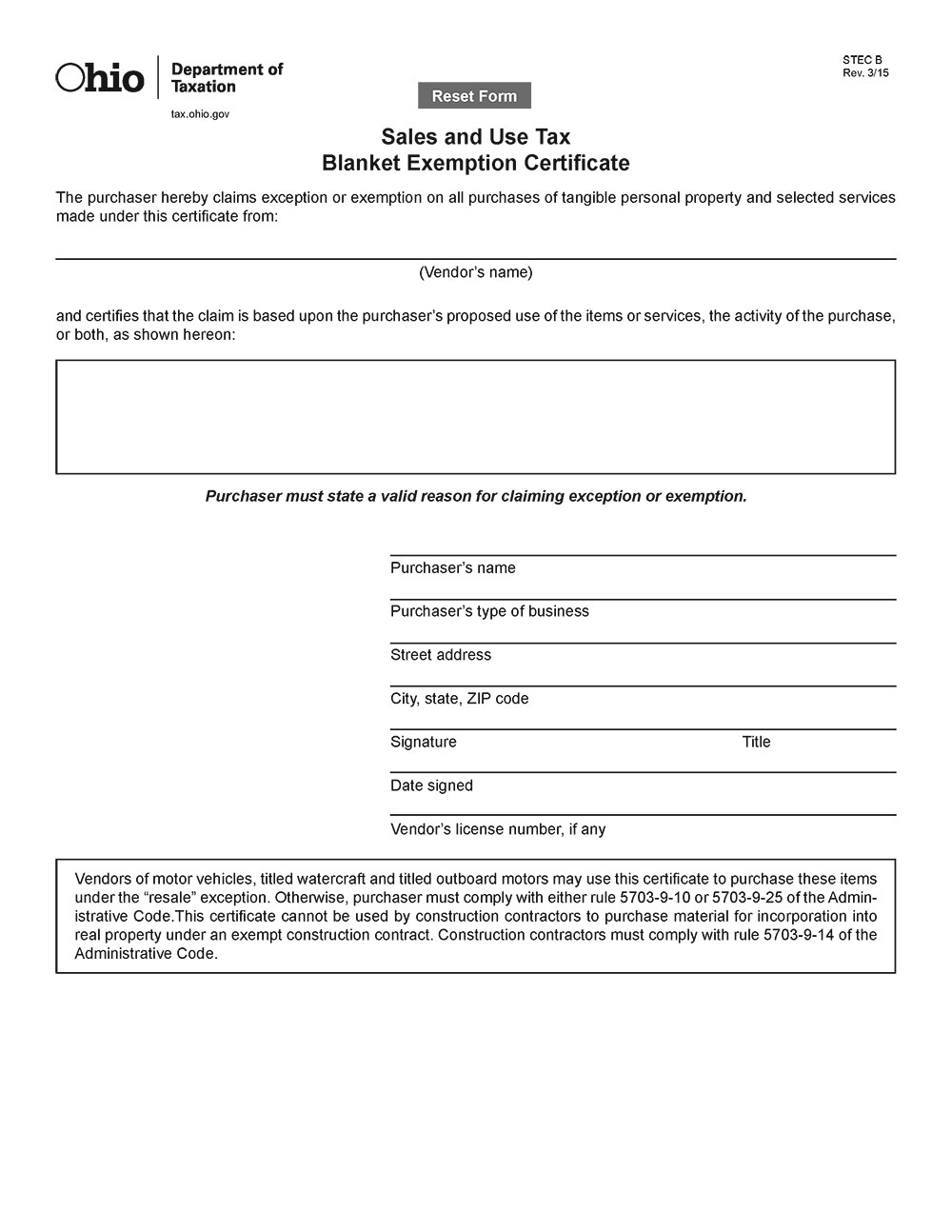

Ohio Revenue Code Ann. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The state of Ohio provides certain forms to be used when you wish to purchase tax-exempt items such as prescription medicines.

The Ohio sales and use tax exemption for manufacturers allows businesses to purchase tangible personal property to be used or consumed in the manufacturing process. Thats because Ohios sales tax law is a bit tedious and complicated. SALES TO THE STATE OR.

Sales and use tax. The law has several agricultural exemptions but it can be challenging to understand who can claim them. The Unit Exemption Certificate is utilized for the majority of.

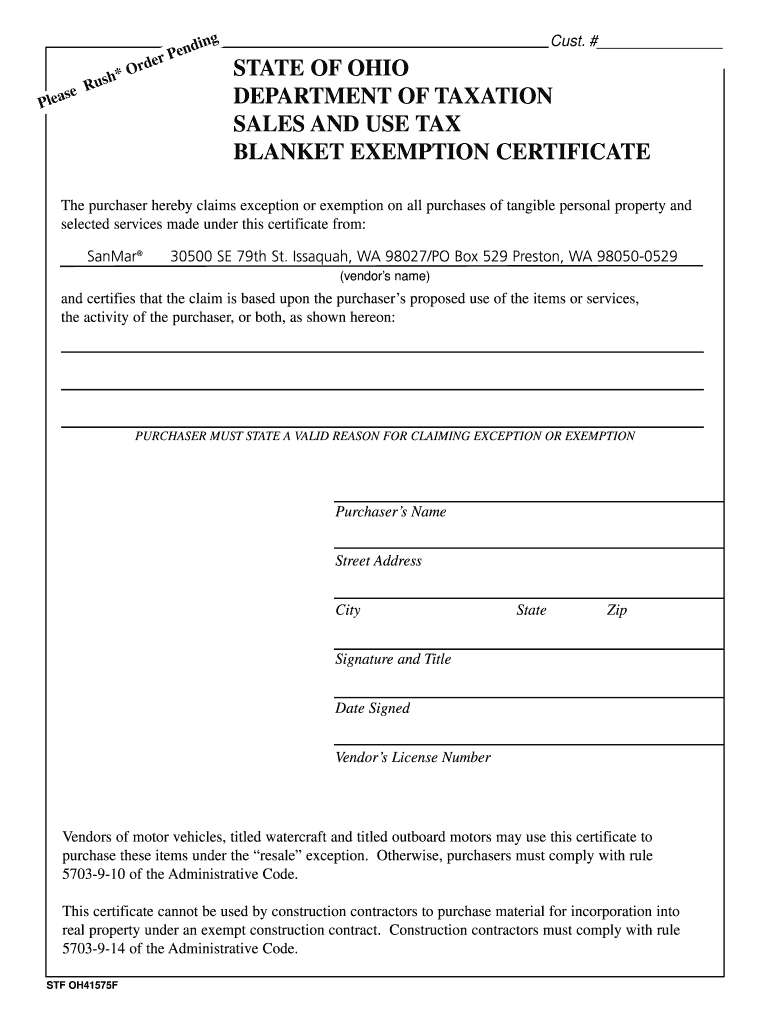

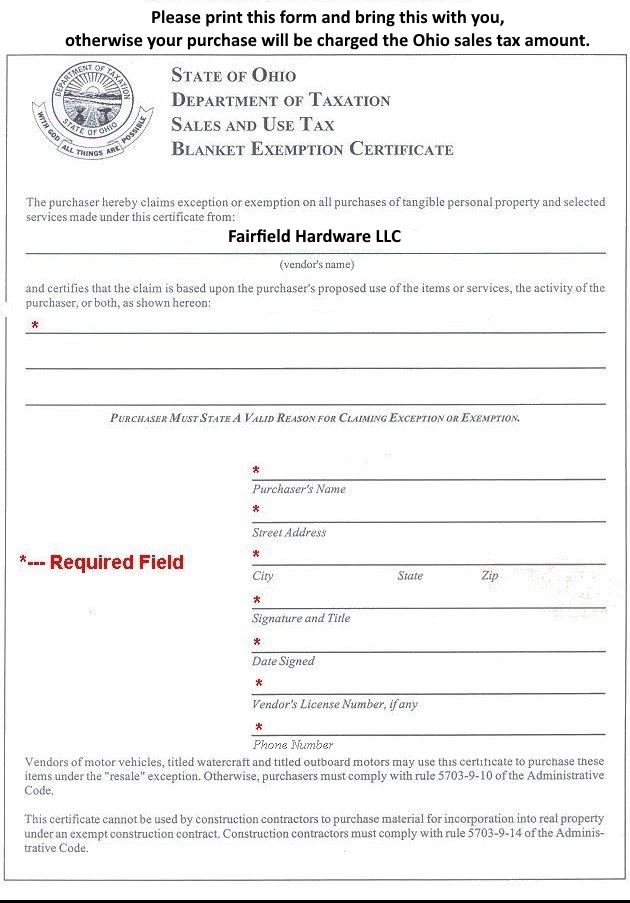

Unlike the property tax which has a superpriority status under IRC 6323b6 a state county or municipal lien. The Ohio state sales tax rate is 575 and the average OH sales tax after. A completed form requires the vendors name the reason claimed for the sales tax exemption and the purchasers name address signature date and vendors number if the purchaser has.

As of August 2011 Ohio imposes a 55 percent sales and use tax on qualifying retail transactions and exchanges of services. Sales tax can be scary especially when. A As used in this rule exception refers to sales for resale that are excluded from the definition of retail sale.

RD Resale Demonstrator An exemption is available when a motor vehicle dealer new used leasing salvage or out-of-state obtains title for resale. Complete Edit or Print Tax Forms Instantly. Ohio Sales Tax Exemption Form.

Ad Download Or Email STEC B More Fillable Forms Try for Free Now. Step 3 Describe the reason for claiming the sales tax exemption. Ad Access Tax Forms.

Utah Student Loan Forgiveness Programs Student Loan Forgiveness Power Of Attorney Form Utah

Ohio Tax Exempt Form Holland Computers Inc

Ohio Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Country Mfg Ohio Tax Exemption Form Faxable

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

Tax Exempt Form Ohio Fill And Sign Printable Template Online Us Legal Forms

New Bulletin Explains Ohio S Sales Tax Exemptions For Agriculture Farm Office

Ohio Farm Sales Tax Exemption Form Tax

Ohio Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Fairfield Hardware Ohio Tax Exemption Form

How To Get A Sales Tax Exemption Certificate In Ohio Startingyourbusiness Com

Ohio Resale Certificate Trivantage

Farm Bag Supply Supplier Of Agricultural Film

Requirements For Tax Exemption Tax Exempt Organizations

Arizona Student Loan Forgiveness Programs Arizona State Of Arizona Arizona State