owner draw report quickbooks

The business owner determines a set wage or amount of money for themselves and then cuts a. 2 Create an equity account and categorize as Owners Draw.

Rppc Inc Quickbooks Accounts Receivable Aging Reports Youtube

For more details on how to record an owners draw in Quickbooks keep reading.

. I just want a report on owners draw. Open the QuickBooks Online application and click on the Gear sign. At the bottom left choose Account New.

When the owner of a business takes money out of the business bank account to pay personal bills or for any other personal expenditures the money is treated as a draw on the owners equity in the business. Draws can happen at regular intervals or when needed. The draw account is for tracking funds taken out use a different equity account for tracking funds in.

Enter the account name Owners Draw is recommended and description. If youre curious about the notion of tracking the withdrawal of company assets to pay an owner in QuickBooks Online keep reading. 1 Create each owner or partner as a VendorSupplier.

Expenses VendorsSuppliers Choose New. First you can view the accounts balances by viewing their register. With the help of an owners draw account you are enabled to record any kind of withdrawals from the bank account.

The second way to view the balance is to run the Balance Sheet Report scroll down to the Equity section and youll see the sub-accounts from there along with their balances. We also show how to record both contributions of capita. For a company taxed as a sole proprietor or partnership I recommend you have the following for ownerpartner equity accounts one set for each partner if a partnership.

October 15 2018 0559 PM. Recorded in Q as a transfer. An owners draw is a financial account in Quickbooks thats used to track payments made to the business owner hence the name.

By recording these transactions in an owners draw youll have an easier time keeping track of your businesss finances. Click Save Close. Owner draw is an equity.

Select the. To write a check from an owners draw. There are three ways on how you can see the balances for both equity and sub-accounts in QuickBooks Online.

People who searched pasiones tv novelas also searched 8Q Las mejores novelas turcas en español gratis disfruta de tus series y telenovelas. Owners equity is also where a family living or draw account would be located if the business is providing for personal needs of the owners and an. Every business owner must pay him or herself sooner or later.

THUS theres no such thing as an Owners Draw. Know that you can select the equity account when creating a check for the owner. Recording draws in Quickbooks requires setting up owner draw accounts and posting monies taken out of the business bank account for personal reasons to.

An owners draw account is a type of equity account in which QuickBooks Desktop tracks withdrawals of assets from the company to pay an owner. Category Type Equity. Its simply a transfer of funds from your business pocket to your personal pocket.

Create an Owners Equity account. The funds are transferred from the business account to the owners personal bank account. This way you will never miss any transaction done for or in favor of business growth.

This article describes how to Setup and Pay Owners Draw in QuickBooks Online Desktop. Choose Lists Chart of Accounts or press CTRL A on your keyboard. Learn about Recording an Owners Draw in Intuit QuickBooks Online with the complete ad-free training course here.

Details To create an owners draw account. There are three ways on how you can see the balances for both equity and sub-accounts in QuickBooks Online. With the investment and draw account being sub accounts of owners equity.

The business owner takes funds out of the business for personal use. An owners draw account is an equity account used by QuickBooks Online to track withdrawals of the companys assets to pay an owner. If you own a business you should pay yourself through the owners draw account.

This tutorial will show you how to record an owners equity draw in QuickBooks OnlineIf you have any questions please feel free to ask. This will handle and track the withdrawals of the companys assets to pay an owner. Enter and save the information.

Before you can pay an owners draw you need to create an Owners Equity account first. In this video we demonstrate how to set up equity accounts for a sole proprietorship in Quickbooks. Navigate to the Account Type drop-down and select the Equity tab.

Owner draw report quickbooks Monday March 7 2022 Edit. All the withdrawals will be recorded in this account which is done by the owners. Select Chart of Account under Settings.

Owners draw balances Tap the Gear icon and choose Account and Settings. December 10 2018 0530 PM. So your equity accounts could look like this.

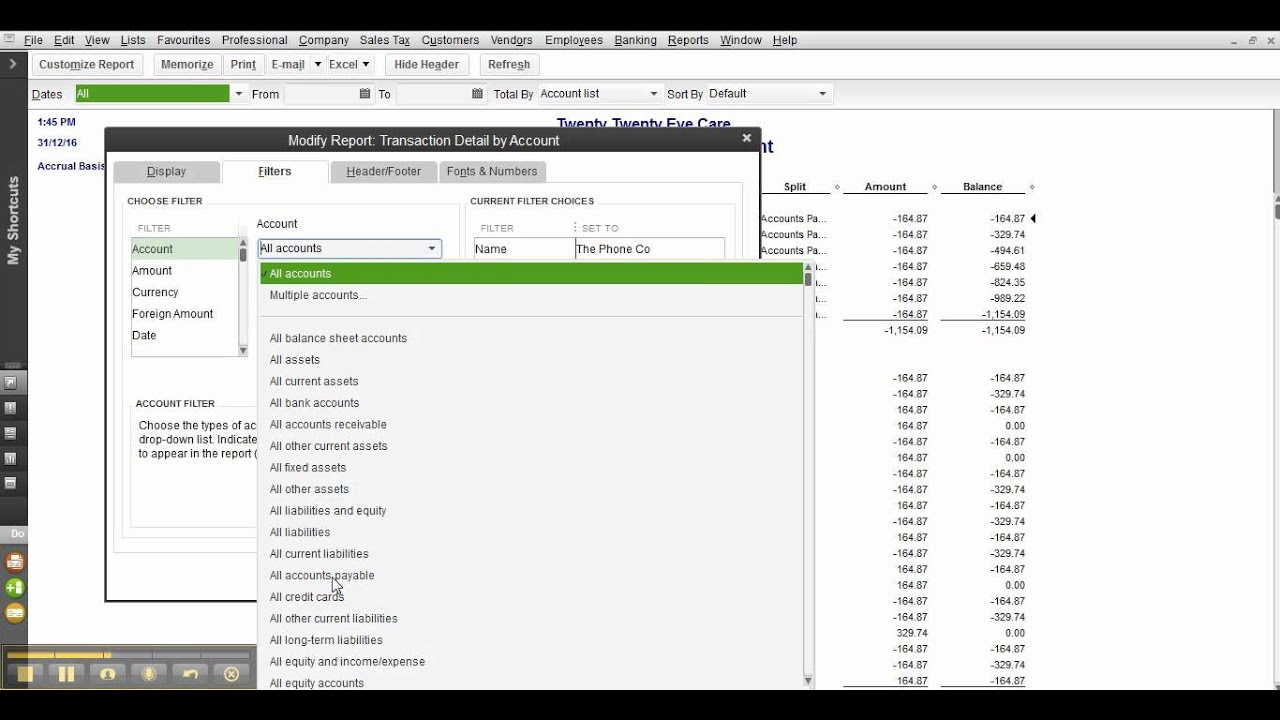

Heres a high-level look at the difference between a salary and an owners draw or simply a draw. Open the chart of accounts use run report on that account from the drop down arrow far right of the account name. This way the said transaction will show up under the Equity account of your Balance Sheet report.

It is another separate equity account used to pay the owner in QuickBooks. Here are few steps given to set up the owners draw in QuickBooks Online. Now hit on the Chart of Accounts option and click new.

In Q you and the business are considered to be a single tax entity if the data for both is in a single Q data file. Follow these steps to set up and pay the owner. Perform a Search in the Community on Owner Draw and read them.

Quickbooks bookkeeping cashmanagementIn this tutorial I am demonstrating how to do an owners draw in QuickBooks-----Please watch. Dont forget to like and subscribe. You have an owner you want to pay in QuickBooks Desktop.

If you have any video requests or tutorials you would like to see make sure to leave them in the com. The best way to do it would be to go back and change the expense account from Owners Personal Expenses to Owners Draw equity account for each transaction if there arent a prohibitively high number of them. An Intuit video presented by Silicon Harbor Business Services of Mount Pleasant and Charleston SC.

That would keep the. Click Equity Continue. Quickbooks Tutorials Uncategorized.

When recording an owners draw in QuickBooks Online youll need to create an equity account. An owners draw is a separate equity account thats used to pay the owner of a business.

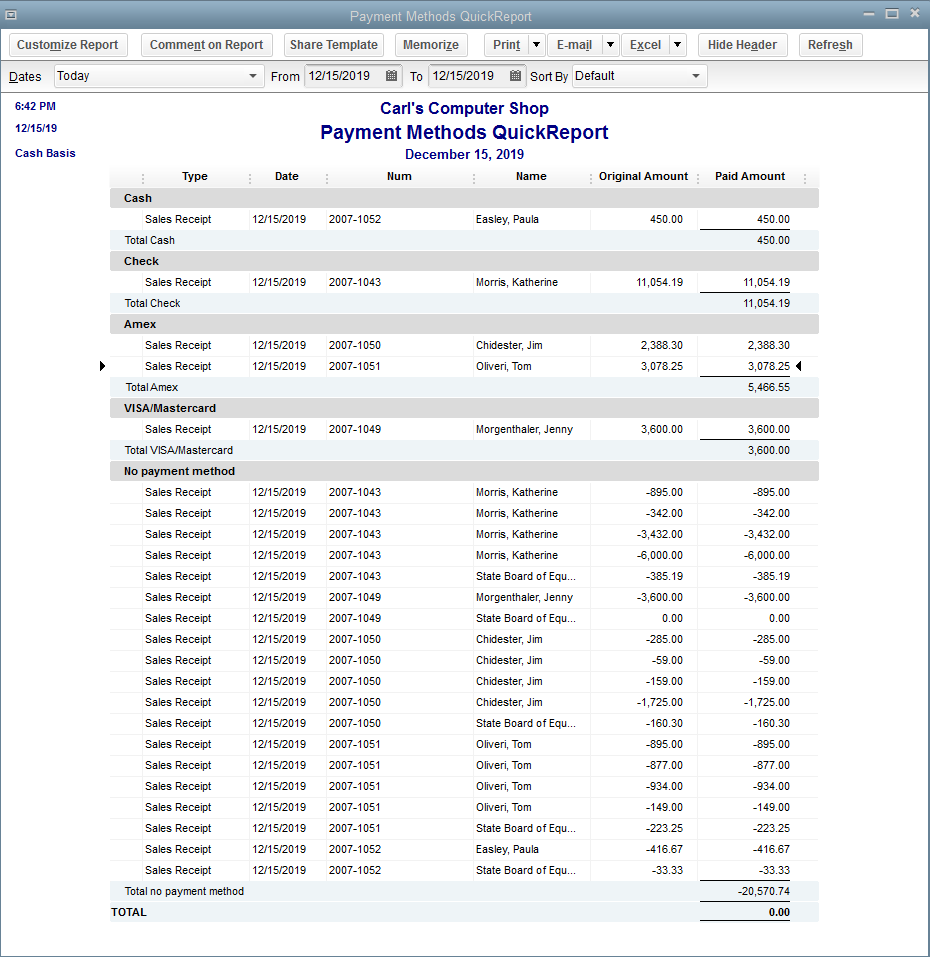

Daily Z Out Report For Quickbooks Desktop Sales Insightfulaccountant Com

Premium Photo Businessman Analyzing Company Financial Report With Augmented Reality Graphics Accounting Bookkeeping Services Accounting Services

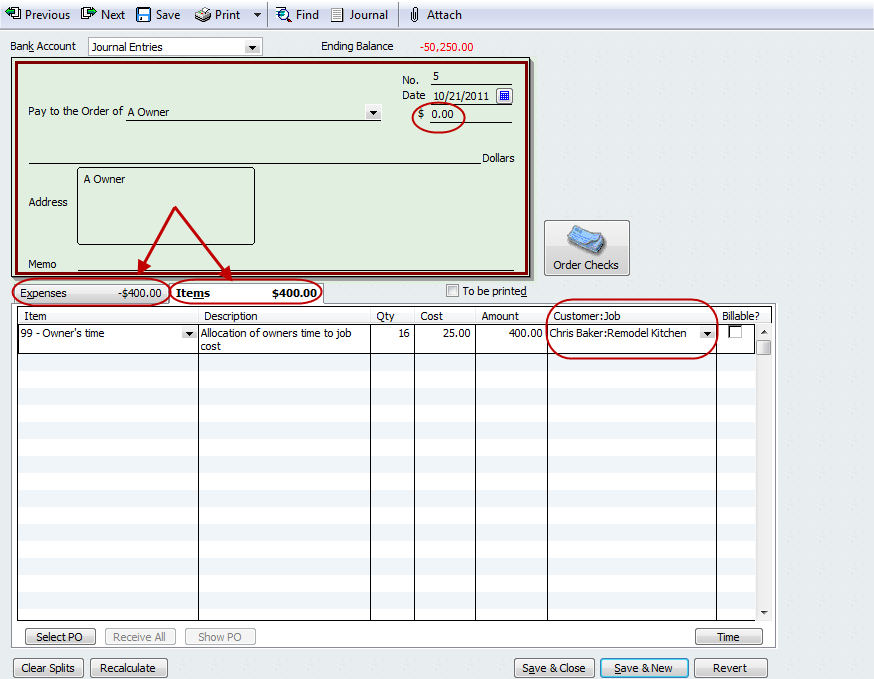

Quickbooks Tip Applying Owner S Time For Job Costing Long For Success Llc

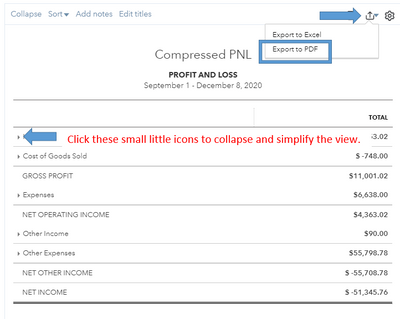

Solved Custom Profit And Loss Report

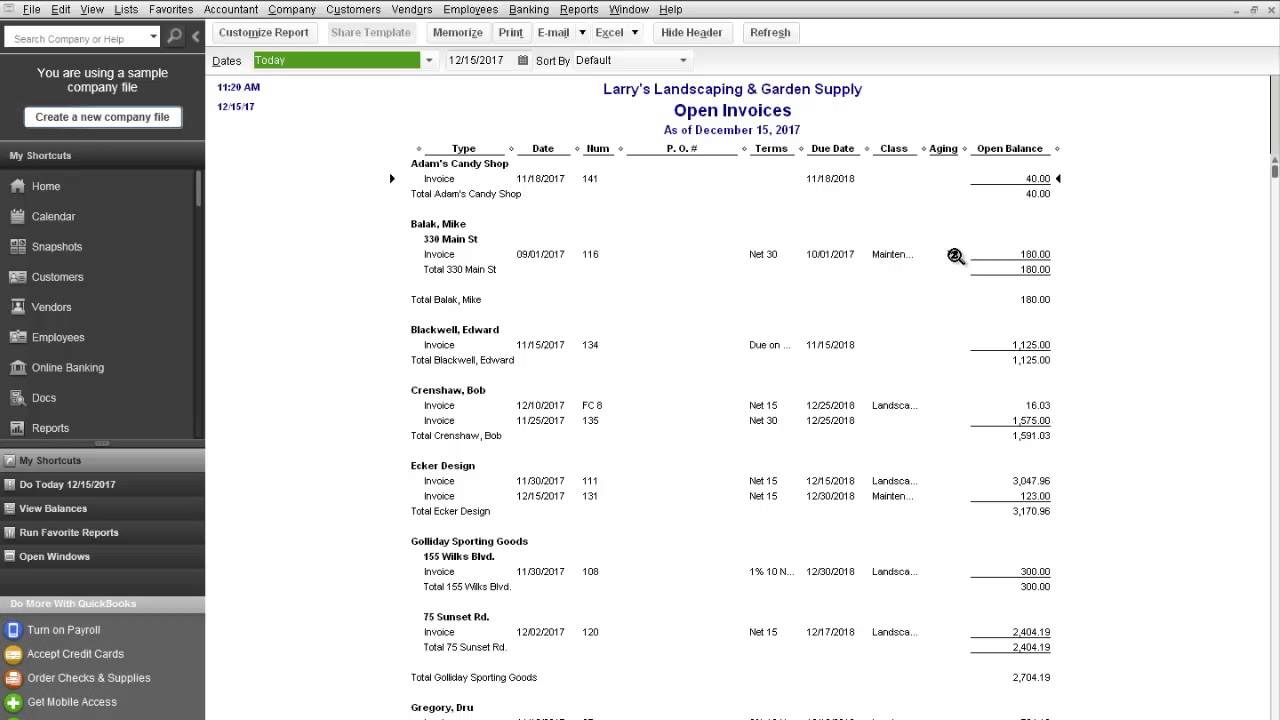

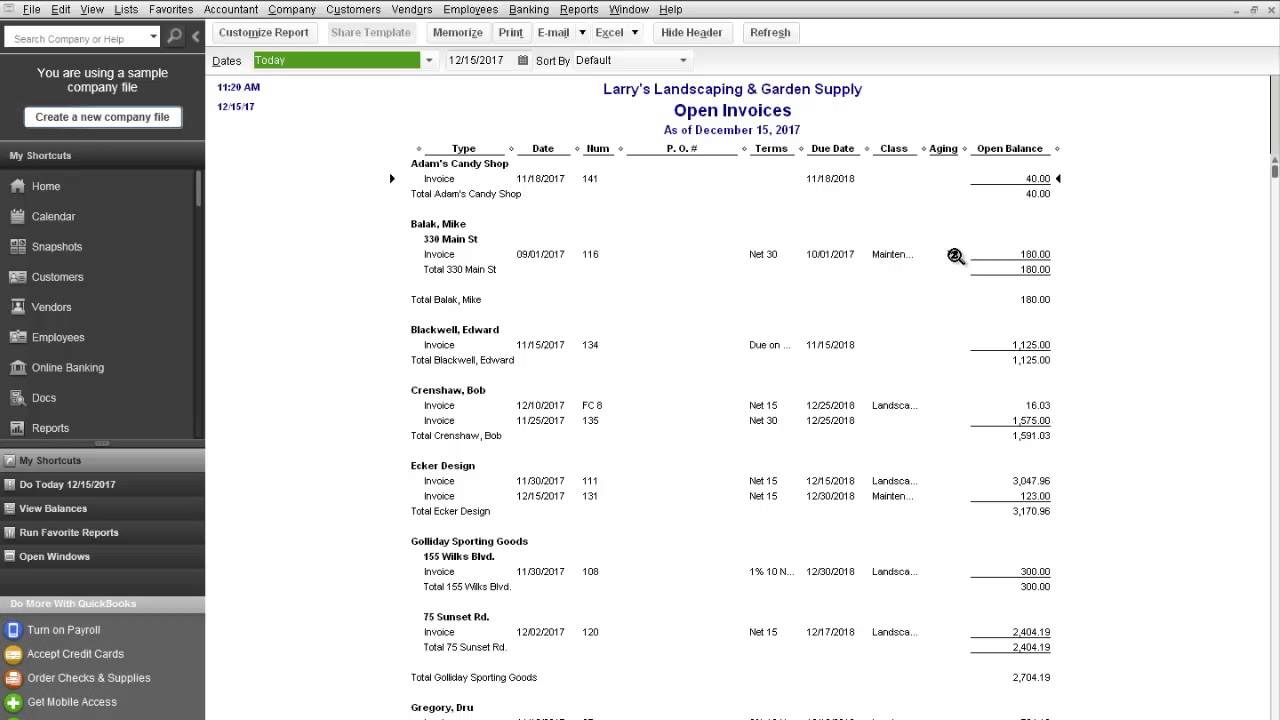

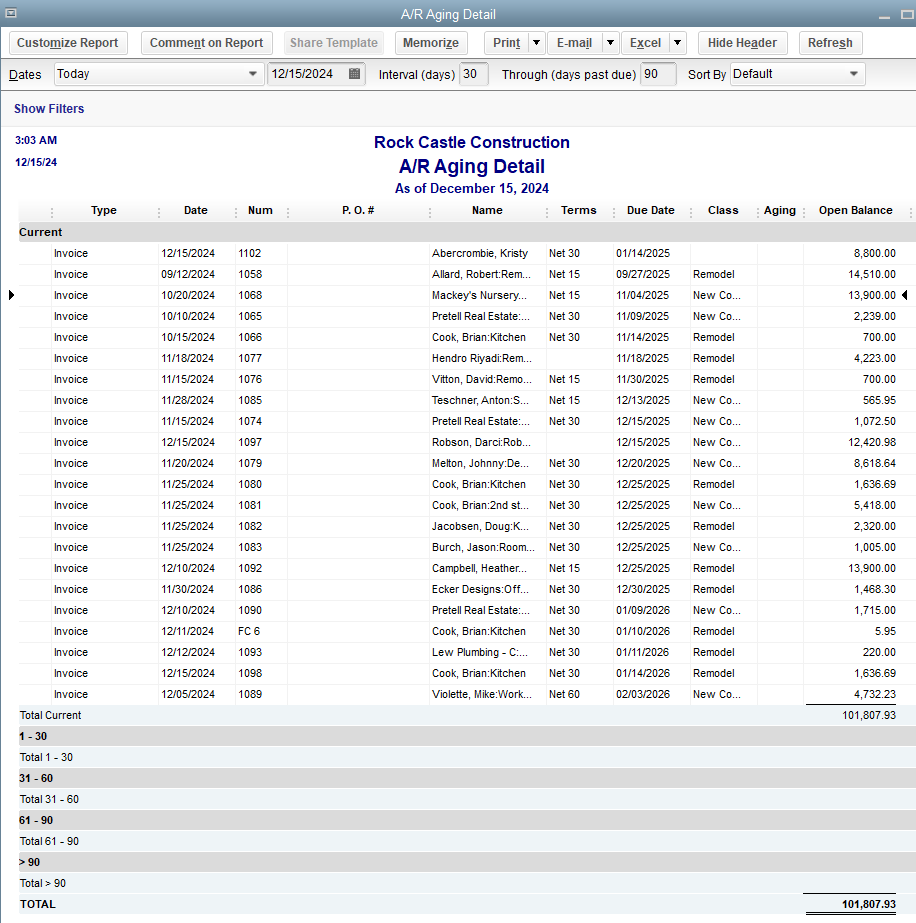

Accounts Receivable Aging Report

Minutes Matter In The Loop Paying Amp Reimbursing Yourself In Quickbooks Chart Of Accounts Quickbooks Accounting

How Can I Create A Report For All Invoices Created In A Specific Month Does Not Matter If They Are Unpaid Just Want The Total Of All Sales Made Thanks

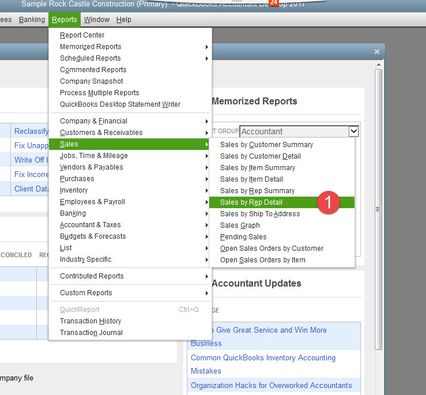

Solved Sales Report That Shows Sales Orders Each Individu

Onpay Payroll Services Review Payroll Software Payroll Advertising Methods

How Can I Run An Owners Draw Report To See The T

Progressive Invoices Quickbooks Create Invoice Invoice Template

Why Is My Quickbooks Profit And Loss Report Not Showing Owner S Draw Quickbooks Tutorial

Quickbooks Job Costing Job Wip Summary Report Quickbooks Data Migrations Data Conversions

Oh Quickbooks You Truly Know The Way To My Heart Is A Big Green Check Mark Office Work Is The Least Glamor Quickbooks Online Quickbooks Small Business Owner

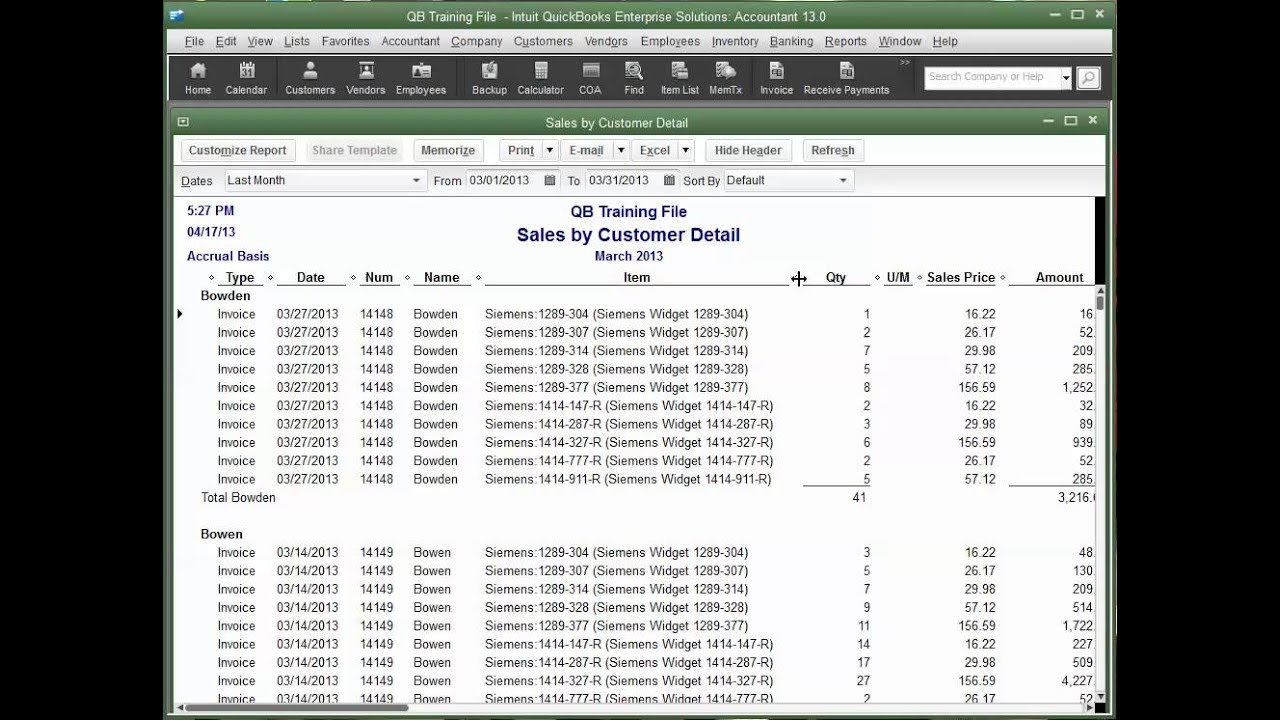

Quickbooks Custom Reports For Items Customers Youtube

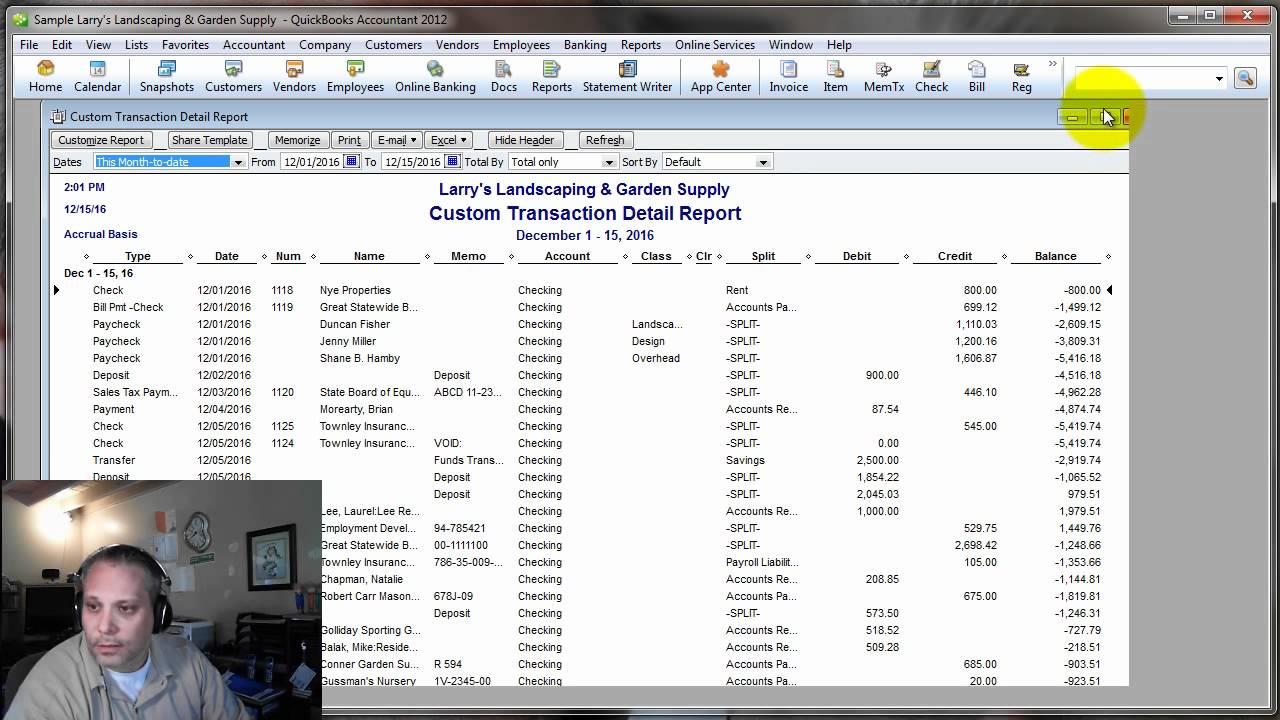

Quickbooks Help How To Create A Check Register Report In Quickbooks Youtube